Fintech on the Move: Why Global Payments Depend on Reliable Connectivity

The fintech economy runs on speed, accuracy, and instant global reach. But behind every payment, every transaction alert, every international remittance, there is a silent backbone: connectivity. As financial services expand across borders and operate in real time, even a few seconds of downtime can disrupt user trust and revenue. This blog explores why reliable connectivity is the cornerstone of global payments today and how advanced eSIM management solutions like Voye Data Pool keep fintech operations seamless, secure, and future ready.

Digital finance has entered an era where money moves across borders in seconds and financial ecosystems operate without physical boundaries. Whether a user is sending money home, paying for a subscription, topping up a mobile wallet, or buying cryptocurrency, real-time connectivity is the core requirement enabling every single digital interaction.

The world’s most innovative fintech companies including payment gateways, neobanks, remittance apps, card issuers, trading platforms, BNPL providers, and digital lending ecosystems depend on uninterrupted global connectivity to process transactions instantly and securely.

Yet this critical dependency is often overlooked. Most discussions in fintech revolve around compliance, KYC, fraud prevention, or UX design. But the reality is simple.

None of these systems function without reliable, secure, always-on connectivity.

And as fintech becomes more global, more mobile, and more automated, this dependency becomes even more crucial.

This is where advanced eSIM technology and intelligent connectivity management, specifically platforms like Voye Data Pool, reshape how fintech infrastructure operates at scale.

The Global Fintech Boom: Speed, Reach, and Constant Uptime

Fintech has grown into a trillion-dollar global sector driven by three forces:

1. Borderless digital products

2. Mobile-first experiences

3. Instant, always-active operations

All three depend directly on stable connectivity.

The world expects real-time everything

A user tapping their phone to pay expects confirmation in milliseconds.

A traveler making a card purchase abroad expects instant approval.

A business receiving an international payment needs immediate settlement notifications.

Behind each of these moments is a series of interconnected technologies involving APIs, authentication layers, cloud databases, fraud detection engines, and global payment rails that rely on continuous connectivity.

When connectivity fails, fintech fails. Not in theory, but in real user experience.

Global expansion increases dependence

Fintech providers now operate across:

- multiple countries

- multiple regulatory frameworks

- multiple currencies

- distributed cloud environments

- cross-border data centers

- globally spread teams

This expansion makes network reliability non-negotiable.

Even a one-minute outage can mean:

- thousands of failed transactions

- chargebacks

- compliance hits

- fraud gaps

- brand damage

- user distrust

Fintech does not get maintenance windows. It requires 24 by 7 connectivity with zero tolerance for downtime.

Connect Teams Globally

Borderless connectivity for remote financial operations.

Why Connectivity Is the Lifeline of Global Payments

These are the core reasons why stable connectivity directly determines the success of global fintech operations.

1. Real Time Payment Processing

Every payment follows a journey:

authorization, authentication, routing, confirmation, settlement.

Each stage depends on:

- instant API calls

- secure network routes

- uninterrupted cloud access

A dip in connectivity for even a few seconds can disrupt:

- UPI transactions

- card payments abroad

- QR payments

- gateway flows

- wallet top-ups

- merchant settlements

Fintech’s value lies in real-time access. Connectivity enables it.

2. Cross-Border Transactions Require Stable, Borderless Networks

International payments require:

- multi-country verification

- currency conversion APIs

- global KYC databases

- fraud engines across jurisdictions

- cloud systems operating across continents

Connectivity failures cause instant declines or compliance errors.

Global payment reliability depends on global connectivity.

3. Fraud Prevention Engines Depend on Live Data

Modern fraud models rely on:

- device fingerprints

- location signals

- real-time behavioral analysis

- instant transaction scoring

- IP matching

- velocity checks

A connectivity gap means fraud engines cannot run live checks. That leads to:

- suspicious transactions

- unauthorized payments

- false approvals

- false declines

Reliability protects both businesses and users.

4. Mobile-First User Experiences Require Zero Downtime

Most fintech users operate primarily on mobile apps. Many fintech employees including field agents, KYC operatives, and remote support teams also rely on mobile connectivity.

Unstable connectivity results in:

- failed logins

- broken app flows

- delayed notifications

- abandoned payments

- blocked disbursements

Fintech is mobile. Therefore connectivity must be mobile, global, and consistent.

5. Cloud Banking Infrastructure Cannot Work Without Stable Networks

Fintech systems are built on cloud platforms such as AWS, GCP, and Azure.

APIs, databases, transaction queues, and monitoring dashboards need uninterrupted access.

If cloud cannot connect, fintech cannot function.

6. Compliance, KYC, and AML Checks Require Real Time Connectivity

Identity verification systems depend on:

- instant document uploads

- face match engines

- real-time OCR

- global watchlist checks

- geolocation signals

Even minor network latency can disrupt KYC workflows.

Connectivity equals compliance readiness.

7. Global Teams and Distributed Operations Need Unified Connectivity

Fintech companies operate with:

- remote engineering teams

- global support centers

- cloud security analysts

- regional compliance officers

Team collaboration, systems monitoring, and secure access all rely on stable connectivity across borders.

Why eSIM Technology Is Becoming Fintech’s Hidden Infrastructure

Traditional SIM cards, local SIM shops, and roaming plans are not built for global fintech operations.

eSIM solves this with:

- instant activation

- borderless connectivity

- remote onboarding

- profile switching

- multi-network redundancy

- tamper-resistant security

For fintech platforms dealing with sensitive, time-critical data, eSIM is a strategic necessity.

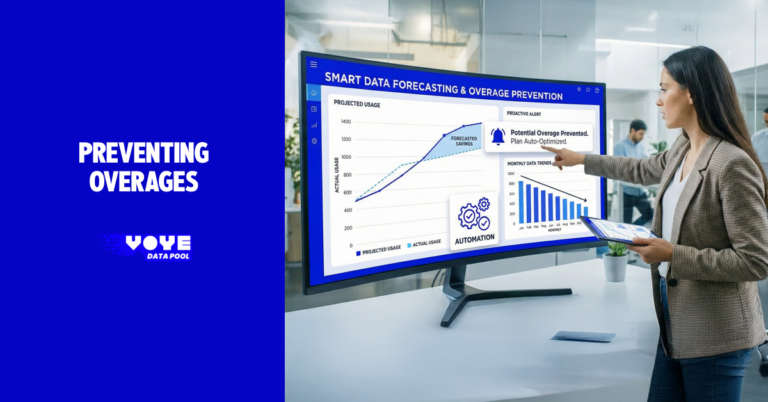

Voye Data Pool: The New Standard for Fintech Connectivity

Reliable, Scalable, Global eSIM Management

Voye Data Pool provides enterprise-grade connectivity designed for modern fintech infrastructure. It simplifies, secures, and scales connectivity across:

- global teams

- mobile-first operations

- IoT devices

- distributed fintech systems

- cross-border transaction environments

Instant Activation for Global Teams and Financial Operations

One of the standout features of Voye Data Pool’s eSIM is instant connectivity.

Upon landing in any country, users can activate the eSIM and be online within minutes without searching for local SIM shops or dealing with roaming inconsistencies.

This reduces downtime and increases operational stability for fintech teams that depend on real-time responsiveness.

Enterprise Connectivity for Mission Critical Systems

Fintech companies trust Voye Data Pool because it provides:

- multi-network redundancy

- high availability connectivity

- secure encrypted routing

- dynamic global coverage

- scalable pooled data

This ensures operational continuity across geographies for payment processing, compliance workflows, international card usage, and mobile workforce operations.

How Fintech Companies Use Voye Data Pool in Real Operations

1. Global Product and Engineering Teams

Develop and monitor fintech apps worldwide without connectivity gaps.

2. Cross-Border Payment Processing

Maintain uninterrupted cloud connectivity from any region or time zone.

3. Field KYC and Onboarding Teams

Ensure real-time uploads and identity checks even in low coverage zones.

4. IoT Financial Hardware

POS systems, card readers, kiosks, ATMs, and payment terminals require stable connectivity.

5. Remote Operations and Distributed Offices

Teams stay securely connected without relying on public networks.

Fintech’s Future Depends on Intelligent Connectivity

By 2030, global payment volumes will multiply, and complexity across risk, cross-border regulations, and digital identity will also grow.

Connectivity will shift from being an operational requirement to a competitive advantage.

Fintech companies with advanced connectivity infrastructures will outperform others through:

- higher transaction success rates

- stronger fraud detection

- faster onboarding

- reduced latency

- better global customer trust

Advanced eSIM management will become a foundational layer of fintech innovation.

Conclusion

Fintech thrives on mobility, speed, and global reach. But none of it functions without reliable connectivity.

From real-time payments to compliance systems, from distributed teams to intelligent fraud detection, connectivity is the backbone of modern financial innovation.

As the fintech landscape accelerates, companies must adopt technologies that ensure stability, scalability, and uninterrupted uptime.

Voye Data Pool, with advanced eSIM management, secure routing, and instant global activation, delivers exactly what fintech companies need to stay ready for a borderless digital future.

Scale Without Limits

Future ready eSIM solutions for growing fintech ecosystems.

6 min read

6 min read